German Information Economy - Optimistic Forecasts in the Information Economy

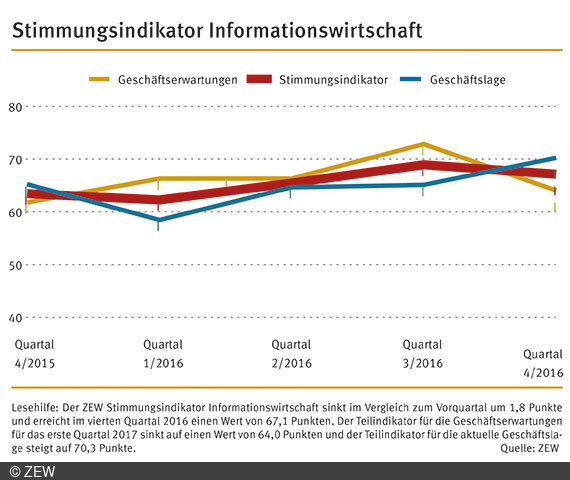

Information EconomyThe third quarter of 2015 is characterised by a good economic climate among companies in the German information economy. The majority of companies positively assess both their current business situation and the economic outlook for the fourth quarter of 2015, as suggested by the ZEW Economic Sentiment Indicator. The indicator has climbed by 0.7 points quarter-on-quarter to a reading of 64.4 points. This is the result of a survey conducted by the Centre for European Economic Research (ZEW) in September 2015 within the information economy.

The increase in the Sentiment Indicator was driven by the positive development of business expectations regarding the fourth quarter of 2015. The corresponding sub-indicator exceeds the value recorded in the previous quarter by 3.1 points, thereby reaching a current total of 69.3 points. The majority of companies expect rising revenues and growing demand for their products or services in the fourth quarter of 2015. The sub-indicator for the business situation has dropped by 1.4 points compared to the previous quarter, falling to a reading of 59.9 points. Exceeding the critical 50-point mark, however, the sub-indicator does suggest that the majority of companies currently record a better business situation than they did three months ago.

The information economy sector consists of the sub-sectors information and communication technologies (ICT), media service providers, and knowledge-intensive service providers.

Economic optimism remains prevalent among ICT companies in the third quarter of 2015, according to the Sentiment Indicator. Despite a marginal decrease by 1.7 points, the indicator has reached a strong reading of 68.7 points. This slight drop can be seen as the result of a dampened evaluation of the business situation. The sub-indicator for the business situation has fallen from 66.5 points in the previous quarter to 61.2 points in the third quarter of 2015. Unlike the business situation, business expectations are viewed with greater optimism than three months ago. The corresponding sub-indicator for business expectations has gained 2.2 points, thereby reaching an impressive value of 77.2 points.

Economic sentiment in the media sector has once again improved significantly in the third quarter of 2015. Having exceeded the critical 50-point mark in the previous quarter, the Sentiment Indicator has grown by an additional five points to a reading of 60.9 points. This noticeable improvement in the economic climate is mainly driven by optimistic forecasts for future business performance. The corresponding sub-indicator for business expectations has climbed by 7.5 points to a current value of 68.5 points. Optimism among the majority of media service providers has not only resulted from positive forecasts, but also from a favourable quarter-on-quarter development of the business situation. The corresponding sub-indicator for the business situation has reached 54.2 points in the third quarter.

Knowledge-intensive service providers continue to record a solid, positive business climate. Compared to the previous quarter, the Sentiment Indicator has increased by 1.8 points, thereby reaching a total of 62 points. The sub-indicator for business expectations has risen slightly more than the sub-indicator for the business situation in the current survey. Both indicators have closed at a reading clearly above the 50-point mark: 63.9 points and 60.2 points, respectively. Within the sub-sector of knowledge-intensive service providers, PR and business consultants have provided the most optimistic assessment of both the current business situation and fourth-quarter developments.

For more information please contact

Dr. Jörg Ohnemus, Phone +49/621/1235-354, E-Mail ohnemus@zew.de

The Economic Sentiment Indicator in the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. The sales situation and the demand situation form a sub-indicator reflecting the business situation. Sales expectations and demand expectations form a sub-indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations is the value of the Economic Sentiment Indicator in the Information Economy. The sentiment indicator can take on values from 0 to100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The ZEW Business Survey in the Information Economy

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sectors three to nine make up the knowledge-intensive service providers.

Remark on the Projection

To ensure that the analyses are representative, ZEW projects the answers of the survey participants with the sales value of the businesses with regard to the entire sector of the information economy. The phrasing "share of the businesses" thus reflects the share of sales of the businesses.