Economic Outlook for China Deteriorates Significantly

China Economic PanelChina Economic Panel (CEP) of the Centre for European Economic Research (ZEW) and Fudan University (Shanghai)

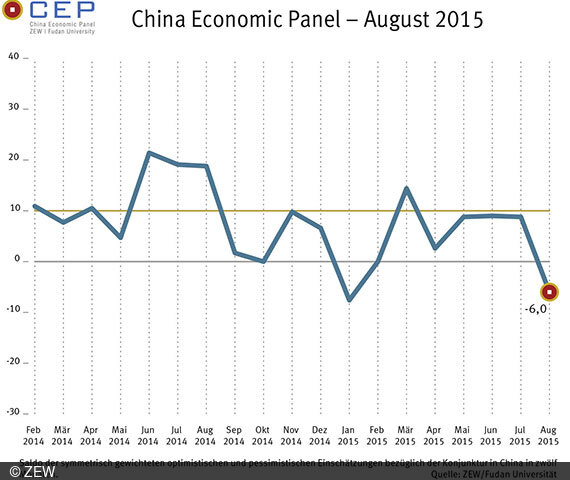

The CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, has deteriorated significantly in the current survey period (August 17-31, 2015). It has dropped from 8.8 to minus 6.0 points. Interestingly, the change in sentiment is not yet reflected in GDP forecasts. The growth figures of 6.9 per cent for 2015 and 6.7 per cent for 2016 are strikingly similar to the forecasts provided by the government. Very likely, the estimates included in the CEP Indicator are much more realistic, since there is no government equivalent to this indicator.

The survey results show that the participants expect the Chinese government to take measures that aim at stabilising economic growth. Regarding interest rates, financial market experts forecast a significant decline in short-term interest rates as well as in interest on credit. In addition, the surveyed experts expect a further depreciation of the Yuan against the USD. However, the depreciation is likely to be slowed down by government interventions, as suggested by the expected reduction of foreign exchange reserves.

In particular the automotive, electronics, and energy sectors are the industrial branches to be hit by the economic downturn, according to CEP experts. The survey participants furthermore expect a negative development for investment banking and the insurance industry, which may be largely attributed to the recent stock market slide in China. Recovery is not expected on a three-month horizon in this area; quite to the contrary, the decline in stock prices might even increase further.

Experts forecast slight improvement within one year for two sectors only, construction and engineering. This may be caused by the additional government infrastructure spending that the survey respondents expect.

When it comes to assessing the major economic regions, in particular Tianjin faces a poor economic outlook and deterioration in real estate prices. As a result of the recent disaster at the port of Tianjin, economic sentiment for the region has virtually plunged.

Taken together, the current survey results suggest growing risks for the Chinese economy. At the same time, financial market experts expect additional government interventions that may alleviate the economic slowdown in China.

For further information please contact

Dr Oliver Lerbs, Phone +49 (0)621/1235-147, Fax -223, e-mail lerbs@zew.de