China Economic Panel (CEP) of the Centre for European Economic Research (ZEW) and Fudan University (Shanghai) - Economic Expectations for China to Date Unimpressed by Stock Market Turmoil

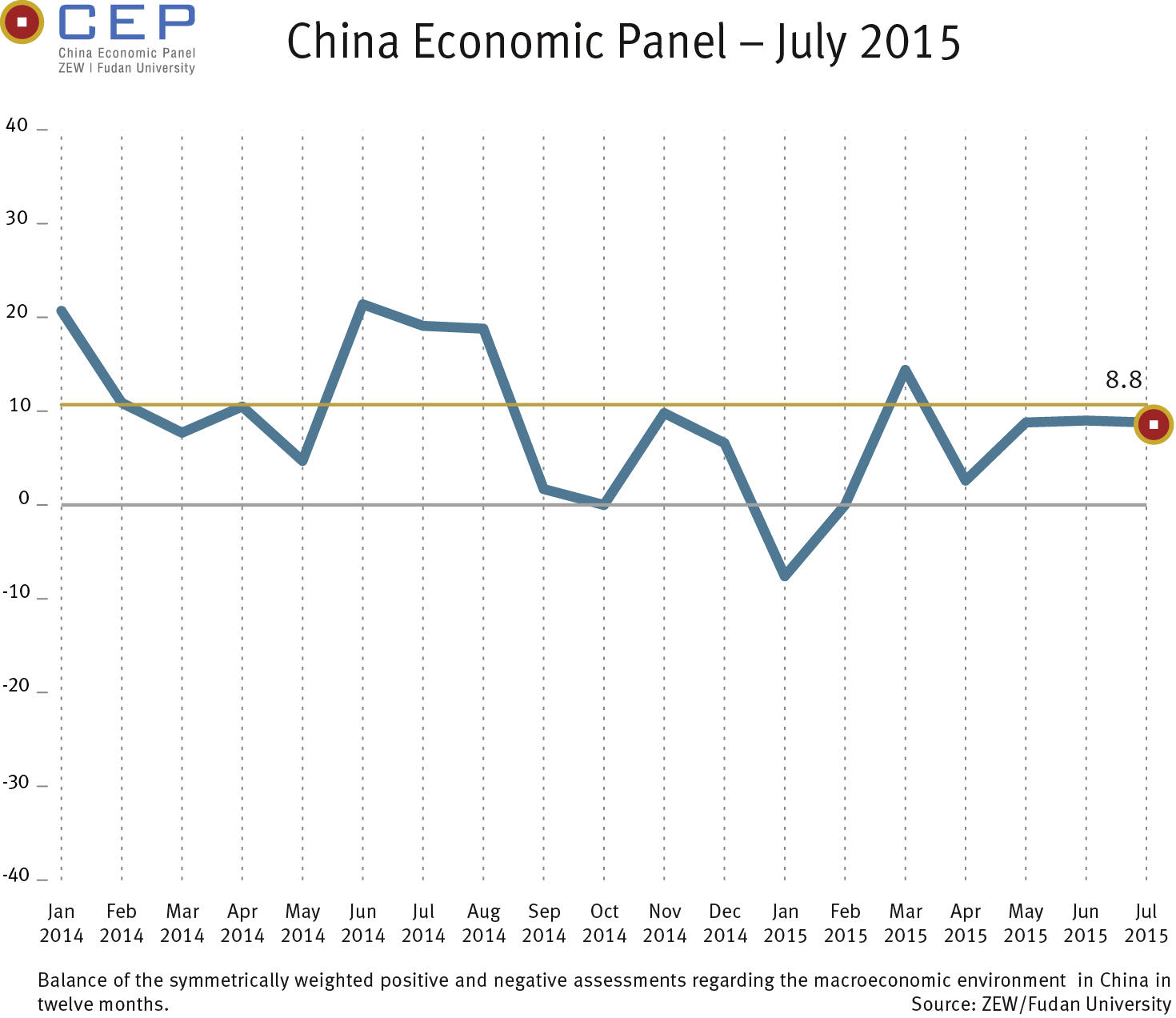

China Economic PanelThe CEP Indicator, which reflects the expectations of international financial market experts regarding China's macroeconomic development over the coming twelve months, has slightly declined in the current survey period (July 14-30, 2015). The indicator has dropped from 9.0 to 8.8 points compared to the previous month. Expectations for China's economic development in 2015 and 2016 have hardly changed either compared to the June reading. The surveyed experts forecast an average GDP growth of 6.8 per cent in 2015, and a GDP growth of 6.7 per cent in 2016.

Regarding individual regions in China, however, experts expect a largely heterogeneous development over the coming twelve months. In particular, economic sentiment has cooled significantly for Guangzhou, Shenzhen, Chongqing and Tianjin.

Against the backdrop of deteriorating stock prices in China over the past few weeks and possibly resulting macroeconomic feedback effects, the largely unchanged economic expectations come as a surprise. Smaller profits for banks are possible transmission channels for feedback effects. Sentiment concerning retail as well as investment banking has indeed declined notably among the survey participants. Expectations have also decreased regarding the sectors of mechanical engineering and construction, indicating impending detrimental effects for the real economy.

Expectations, in particular for the SSE Composite Index and the Hang Seng Index, are not yet suggesting stabilising stock prices. To the contrary, experts believe prices will further decline.

For further information please contact

Prof. Dr. Michael Schröder, Phone 49 (0)621/1235-368, e-Mail schroeder@zew.de