Number of M&As Involving German Firms Continues to Fall

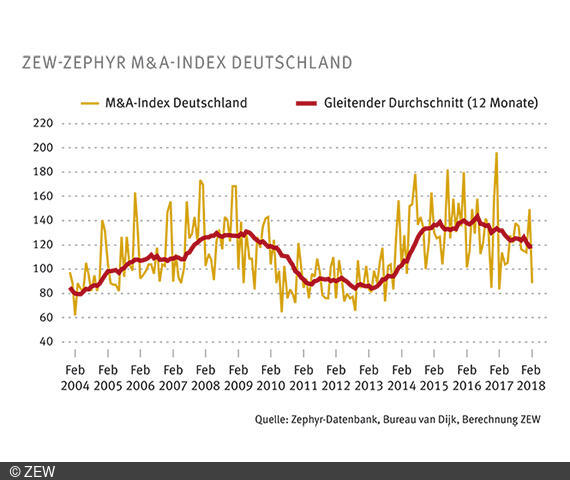

M&A IndexThe number of mergers and acquisitions (M&As) involving German firms continues to drop in 2018. Last year already saw unusually weak M&A activities. Only in the second half of 2017 did they stabilise on a moderate level. This development is clearly discernible in the ZEW-ZEPHYR M&A Index, which reflects the number of M&A transactions conducted in Germany on a monthly basis. The index is calculated by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

The twelve-month moving average of the index has been exhibiting a downward trend since June 2016, and last stood at 119 points. Strong M&A activity of 149 index points in January 2018 nonetheless served to check this decline.

Unlike the number of transactions, transaction volumes have increased in the past few months. This was primarily due to three megadeals with volumes of over a billion euros each. The largest was Deere & Company’s 4.3 billion euro acquisition of the Wirtgen Group, which produces road construction machinery.

Much attention was also given to the acquisition of the Hamburg Südamerikanische Dampfschifffahrts-Gesellschaft (Hamburg Süd) by its Danish competitor, Maersk. After owning the company for over 50 years, the Oetker Group sold Hamburg Süd for roughly 3.7 billion euros at the end of 2017. The acquisition continues the trend toward consolidation in the container shipping sector, where the five largest companies now hold over 60 per cent of market share.

Finally, the Bremer Kreditbank acquired the Oldenburgische Landesbank for 300 million euros from the insurance giant Allianz. The sale signals the end of Allianz’s ambitions to establish an “Allianzbank.” By contrast, it will allow Bremer Kreditbank’s sole owner, the American financial investment firm Apollo, to strengthen its position in Germany.

“The overall robust M&A activity in Germany helped to slow the ongoing downward trend. This corresponds to the good economic development in Germany over the past few years,” says Niklas Dürr, a researcher in ZEW’s Research Department “Economics of Innovation and Industrial Dynamics” and project leader of the M&A Report, which is published biannually.

ZEW-ZEPHYR M&A Index Germany

The ZEW-ZEPHYR M&A Index measures the number of M&A transactions completed in Germany each month. It considers only mergers and acquisitions conducted by and with German companies. It does not differentiate between the country of origin of the buyer or partner involved. This means that both German and international buyer companies are considered, provided that the target companies are active in Germany.

The ZEW-ZEPHYR M&A Index Germany is created by ZEW and Bureau van Dijk on the basis of the Zephyr data base. ZEPHYR provides information on more than 1.7 million M&As, IPOs and private equity transactions worldwide.

For further information please contact

Niklas Dürr, Phone +49 (0)621/1235-386, E-mail niklas.duerr@zew.de