Persisting Optimism in the Information Economy Sector

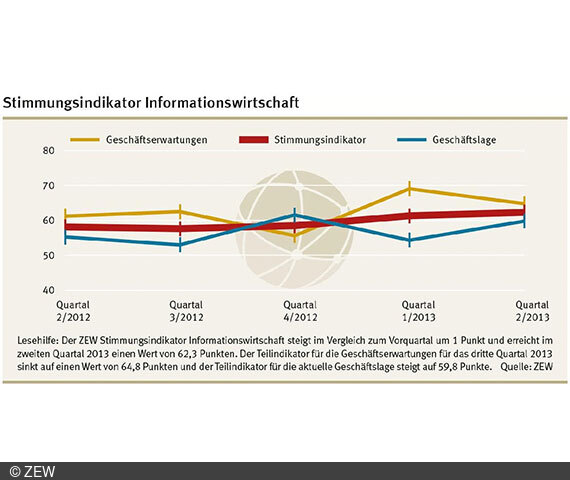

Information EconomySentiment has improved in the information economy for the third time in a row since the second quarter of 2013. Increasing slightly by one point, as compared to the previous quarter, the ZEW Sentiment Indicator for the Information Economy reaches a value of 62.3 points, the highest level in two years. The slight increase of the Sentiment Indicator is attributable to a significantly more positive evaluation of the current business situation. In comparison to the first quarter of 2013, the corresponding sub-indicator increases by 5.5 per cent and now stands at 59.8 points. This is the result of the June-survey by the Centre for European Economic Research (ZEW) on the business situation in the information economy (see details on the survey at the end of the press release).

Companies in the information economy sector are considerably more positive in their assessment of the business situation in the second quarter of 2013 than at the beginning of the year, but they are less optimistic with regard to the coming months. The sub-indicator for business expectation decreases by 4.3 points and currently stands at 64.8 points. The sub-indicator for business expectation as well as the sub-indicator for the business situation are currently well above the crucial 50-points mark. The positive development in the information economy thus persists.

This optimistic evaluation, however, does not apply to all three sectors of the information economy equally. Business expectations have cooled down in the media sector; the respective sub-indicator decreases by 2.7 points and now stands at 44.1 points, clearly below the 50-points mark. This downward trend indicates that the majority of firms in the media sector expect an unfavourable economic development.

The positive economic development in the ICT sector remains stable. The sentiment indicator for this sub-sector increases by 1.1 points and currently stands at 66.7 points. Business expectations as well as the business situation are on a high level.

The positive development of the business situation of knowledge-intensive service providers outweighs the slight deterioration of business expectations in the second quarter of 2013. As a result, the sentiment indicator for this sub-sector increases by 2.1 points in comparison to the previous quarter and now stands at 62.8 points. The business situation for miscellaneous service providers has developed particularly positive. On balance, more than half of the companies in this sub-sector registered an increase in turnover and demand.

For further information please contact

Dr. Jörg Ohnemus, Phone +49 621/1235-354, E-mail ohnemus@zew.de

The Economic Sentiment Indicator in the Information Economy

The Economic Sentiment Indicator in the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. Sales situation and demand situation form a partial indicator reflecting the business situation. Sales expectations and demand expectations form a partial indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations amounts to the value of the Economic Sentiment Indicator in the Information Economy. The sentiment indicator can adopt values between 0 and 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The Economic Survey Conducted by ZEW

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. The last six sectors make up the knowledge-intensive service providers.

Remark on the Projection

To generate a representative analysis, ZEW projects the answers of the firms participating in the survey with their shares of total turnover realized in the sector of the German IT related service providers. The phrasing ‘share of the businesses’ therewith reflects the share of turnovers of the businesses.