ZEW-ZEPHYR M&A-Index - Sustainable Recovery of M&A Activities Worldwide Is Not Yet in Sight

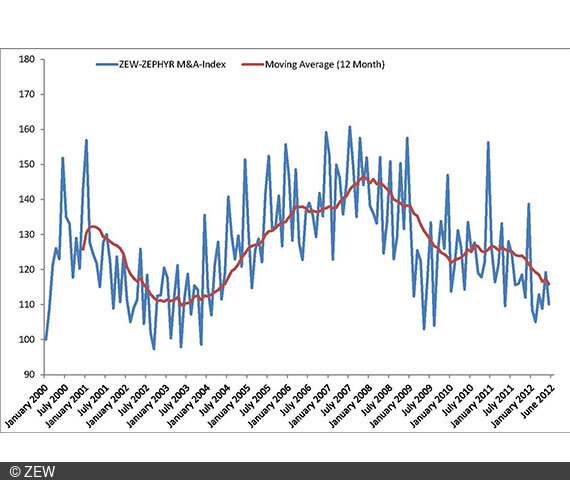

M&A IndexThe worldwide M&A activities caused an emotional roller coaster during the first six months of 2012. The ZEW-ZEPHYR M&A-Index, which reflects the development of mergers and acquisitions completed worldwide, dropped to 105 points in February 2012. That is the lowest level since August 2009 of this indicator calculated by the Centre for European Economic Research (ZEW) and Bureau van Dijk (BvD) on a monthly basis. In fact, the indicator recovered to a level of 119 points until May 2012 just to drop back to 110 points in June. For the second half of 2012, despite an upcoming mega merger, no stimulation of the worldwide M&A activities can by now be identified.

An important reason for the low level of the indicator and for the fact that even on the mid-term, a recovery of the worldwide M&A activities is not to be expected, is the still predominant uncertainty due to the debt crisis within the Eurozone and the associated potential risks of infection for the global economy. The failing of the mega merger between the stock exchanges in Frankfurt and New York during the first half of 2012 did also hardly contribute to a stimulation of the worldwide M&A market. The largest transaction of the first six months of 2012 has been completed in May 2012. By acquiring the gas provider El Paso for an estimated value of 30bn euros, the pipeline company Kinder Morgan Inc., according to statements of the company itself, has become the fourth biggest North American energy company. Further prominent transactions have been realized between Google and Motorola (10bn euro) as well as between the U.S. pharmaceutical company Express Scripts and Medco (22bn euro).

After the ZEW-ZEPHYR M&A-Index could barely increase during the first six months, the expectations until the end of the year are also not very promising. Although the companies could benefit from cheap financing of their planned mergers and acquisition due to low interest rates, the pessimistic economic prospects seem to lower the activities. Moreover, there have also been no changes during the last months concerning the number of rumours of upcoming mergers and acquisitions. Such rumours have proven to be a good early indicator for the future M&A intensity.

But, this year’s mega merger is still to come. With the merger of the commodities marketer Glencore and the mining group Xstrata one of the worldwide largest transactions will probably be realized in the second half of 2012. The deal with a transaction volume of 70bn euros could be a vitalizing momentum for the M&A market.

The ZEW-ZEPHYR M&A-Index is calculated every month by the Centre for European Economic Research (ZEW) and Bureau van Dijk (BvD) and has been tracking the development of mergers and acquisitions completed worldwide since the beginning of 2000. The ZEW-ZEPHYR M&A-Index is based on the number and the volume of global mergers and acquisitions recorded in the BvD’s ZEPHYR database. The index uses the monthly rates of change of both volume and value of M&A transactions, combined and adjusted for volatility and inflation. As a result, the index offers a much more precise picture of the level of worldwide M&A activities than a mere observation of the transaction volume. The reason for this is that a firm's value on the stock exchangehas a strong influence on the transaction value, particularly as many acquisitions are paid for by an exchange of shares. Consequently, stock prices could have a disproportionately strong influence on how the development of M&A transactions is assessed. If, however, the volume is spread over a larger number of transactions within one month, the value of the M&A-Index increases even though the aggregate transaction value remains unchanged.

For further information please contact

Dr. Vigen Nikogosian, E-mail nikogosian@zew.de

Florian Smuda, Phone +49 621/1235-233, E-mail smuda@zew.de