ZEW-ZEPHYR M&A Index - Mega Deals to Spur Global Mergers and Acquisitions

M&A IndexThe global M&A market continues to show a very strong performance. Spurred by a number of record deals, the upward trend at the global M&A market has persisted. This is the result of recent calculations by the Centre for European Economic Research (ZEW) based on the Zephyr database of Bureau van Dijk (BvD).

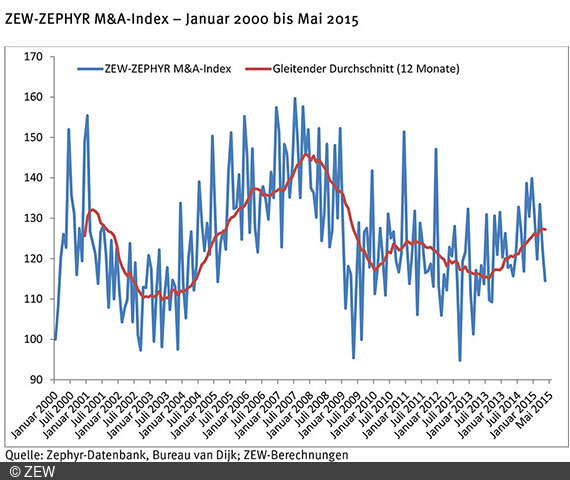

Worldwide M&A activities show a stable and continuous development: In total, the ZEW-ZEPHYR M&A Index has exceeded the 130-point mark six times in the past twelve months. Such a series of strong months is very rare and was last seen in spring 2009. The strongest transactions performance was reported for December 2014, when activities exceeded the 140-point mark for the first time since 2011.

This positive trend is also reflected in the twelve-month moving average of the M&A Index, which has grown continually since the sharp decline in M&A activity between spring 2011 and summer 2013. Two years ago, the twelve-month average of the M&A Index bottomed out at 115.2 points, the lowest level since 2004. As early as in winter 2014, however, the index was back at the April 2011 level (124.5 points), which had marked the peak of the last M&A wave. The twelve-month average of the M&A Index has been rising ever after and currently stands at 127.3 points (as of May 2015). This level had last been exceeded in April 2009.

The reason for this upswing lies in a number of record deals recently struck. Four out of the five biggest deals of the past decade have been reached since early-2014, with three of them having been finalised in the past six months. The largest transaction was the almost EUR 67 billion tie-up in March 2015, which saw the takeover of US botox manufacturer Allergan by Irish-based pharmaceutical giant Actavis plc. Another mega deal was closed in November 2014 with the merger of formerly separated business segments of energy giant Kinder Morgan Inc. The Texan pipeline operator and energy provider accepted to spend about EUR 61 billion for the merger. Another Irish-American mega deal was the roughly EUR 55 billion horizontal takeover of the pharmaceutical and medical technology manufacturer Covidien plc by Medtronic in January 2015.

There is still a long way to go for the twelve-month moving average of the M&A Index to reach its historic high of 145.9 points, which was seen shortly after the beginning of the financial crisis in November 2007. But most certainly, the peak of the current M&A wave has not yet been reached. "We have seen a highly remarkable development within the last two years that is likely to continue. Especially in the pharmaceutical industry, consolidation is far from being completed. Some major players in this industry came away empty-handed in recent mergers and acquisitions, which has left them thirsty for large transactions. Further record deals are thus to be expected in the next few years," says ZEW researcher Sven Heim.

ZEW-ZEPHYR M&A Index

The ZEW-ZEPHYR M&A Index is calculated monthly by the Centre for European Economic Research (ZEW) and Bureau van Dijk (BvD) and has been tracking the development of mergers and acquisitions completed worldwide since the beginning of 2000. The ZEW-ZEPHYR M&A Index is based on the number and the volume of global mergers and acquisitions recorded in BvD's ZEPHYR database. The index uses the monthly rates of change of both volume and value of M&A transactions, which are combined and adjusted for volatility and inflation. As a result, the index provides a much more precise picture of the level of worldwide M&A activities than a simple observation of transaction volumes. The reason for this is that a firm's value on the stock exchange has a strong influence on the transaction value, in particular because many acquisitions are paid for through an exchange of shares. As a consequence, the share price may exert a disproportionately strong influence on the estimation of M&A transaction trends. If the total transaction volume is attributable to a larger number of transactions within one month, the value of the M&A Index increases, even though the aggregate transaction value remains unchanged.

For more information please contact

Sven Heim, Phone +49(0)621/1235-183, E-mail heim@zew.de