ZEW-ZEPHYR M&A-Index Germany – Upturn in Mergers and Acquisitions Likely in 2013

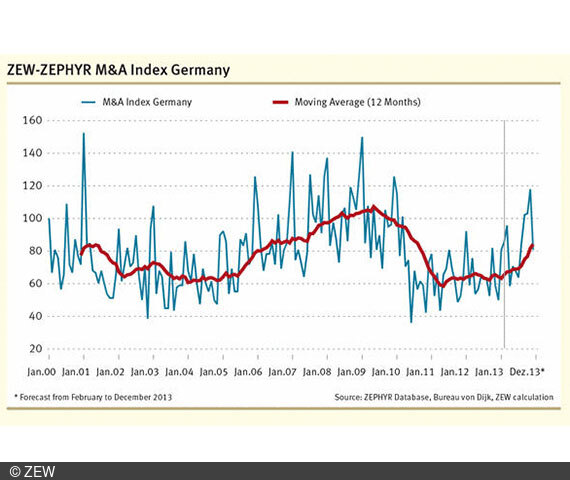

M&A IndexIn the course of 2013, the German M&A-market (mergers and acquisitions) will likely recover. Displaying 81 points in January, the ZEW-ZEPHYR M&A-Index Germany had a promising start into 2013. According to a forecast of the Centre for European Economic Research (ZEW) in Mannheim, the index is likely to rise even further over the coming months. Although the recent development indicates a change of trend, the initial value of the M&A Index Germany of 100 points in the year 2000 is still far from the indicator’s current level.

Based on the ZEPHYR database by Bureau van Dijk (BvD), ZEW regularly calculates the M&A Index for Germany (see end of this press release). The current edition forecasts its development until December 2013. In January, the ZEW-ZEPHYR M&A-Index Germany ranged at 81 points, clearly outstripping the value recorded in December 2012 (50 points) by 31 points. The 12-month moving average of the index has continuously been close to the 60-points mark since the beginning of 2011. The current forecast indicates a period of recovery which terminates the stagnation of the past two years.

The favourable development of the M&A Index Germany is largely due to the positive signals of the indicators used for the calculation of the index. Since October 2012, the OECD’s Composite Leading Indicator (CLI), an early indicator of the economic situation, has been increasing again after the continuous decline in the first half of 2012. The number of rumours about future mergers and acquisitions circulating on the market has also developed favourably and increased by about 18 per cent in the second half of 2012, compared to the first half of the year. The number of rumours is considered to be a suitable indicator for the number of deals that will actually be realised in the future. Furthermore, the DAX increase of the past months and the still low interest rate level signal a turnaround and have a positive impact on the forecast. The number of mergers and acquisitions in Germany could thus increase noticeably in 2013 for the first time after years of stagnation since the beginning of 2011. “Market participants of the M&A environment already confirm increased activity,” says Mark Schwerzel, International Director of BvD.

For further information please contact

Florian Smuda, Phone +49 621/1235-233, E-mail smuda@zew.de

ZEW-ZEPHYR M&A-Index Germany

Using Bureau van Dijk’s (BvD) database, ZEW has designed an M&A index for Germany which shows the development of mergers and acquisitions since 2000. The ZEW-ZEPHYR M&A-Index Germany is calculated on the basis of M&A transactions realised in Germany within a month. Only mergers and acquisitions which include German firms are taken into account for this index. There is no differentiation with respect to the country of origin of acquirers or partners involved. Hence, German as well as foreign acquiring companies are taken into account, while all the target companies considered are active in Germany.