ZEW-ZEPHYR M&A Index for Germany - Little Movement in the Mergers and Acquisitions Market

M&A IndexDespite on-going uncertainties in the euro zone, the German M&A market is remaining attractive to investors, compared to other European countries. A forecast by the Centre for European Economic Research (ZEW) in Mannheim suggests that the number of mergers and acquisitions (M&A) in Germany will continue to stagnate in the second half of 2013 and the first half of 2014.

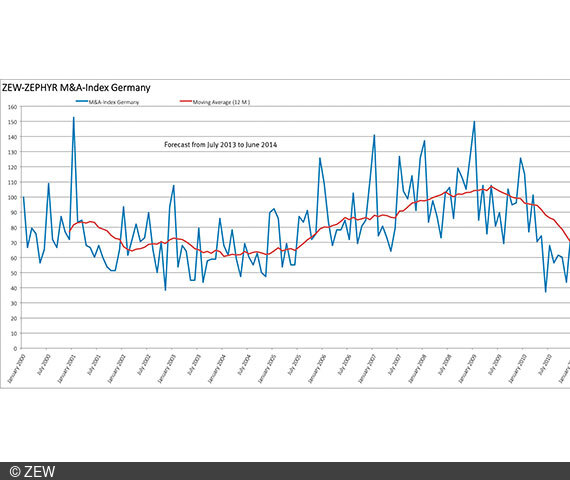

The ZEW-ZEPHYR M&A Index for Germany ranged at 69 points in June 2013 and will be hovering around this level until June 2014, according to the forecast. Despite this persistent stagnation, however, activities on the German M&A market outperform activity on the international market. The international ZEW-ZEPHYR M&A Index, which reflects worldwide mergers and acquisitions, has been decreasing continuously since June 2011 and has thus, other than the M&A Index for Germany, not yet stabilised.

On the basis of the Zephyr database of Bureau van Dijk (BvD), ZEW calculates the M&A Index for Germany (see also diagram at the bottom of this press release) and forecasts its further development on a twelve-month horizon. The current ZEW-Zephyr M&A Index addresses the period until the end of July 2014. In the first half of 2013, there was only little movement on the German M&A market. Since February 2013, the M&A Index for Germany has fluctuated between 56 and 73 points. The 70-points mark could not be exceeded over a longer period in the first half of this year. The current value of 69 points roughly equals the June 2012 level (67 points).

The persistent stagnation on the German M&A market is also reflected by the development of the moving twelve-month average. Following a considerable decline in 2010, the index has continuously ranged between 60 and 69 points since the beginning of 2011. Since January 2012, the index has ranged between 65 and 69 points with a maximum deviation of only four points.

For further information please contact

Florian Smuda, Phone +49 621/1235-233, E-mail smuda@zew.de

The ZEW-ZEPHYR M&A Index for Germany

The ZEW-ZEPHYR M&A Index was developed specifically for Germany and has been tracking the development of mergers and acquisitions since 2000, based on the Zephyr database by Bureau van Dijk (BvD). The ZEW-EPHYR M&A Index for Germany is calculated using the number of M&A transactions in Germany, only factoring in mergers and acquisitions of German firms. The origin country of buyers or partners does not play a role in the calculation. This means that both German and foreign buyers, but only target firms located in Germany, are taken into account.

In particular, macroeconomic conditions like the economic development or the development of financial markets determine M&A activities. Based on an empirical study, the forecast of M&A activities in Germany is calculated by means of the OECD Composite Leading Indicator (CLI) for Germany, the long-term level of interest rates, the development of DAX and the number of rumours regarding future mergers.