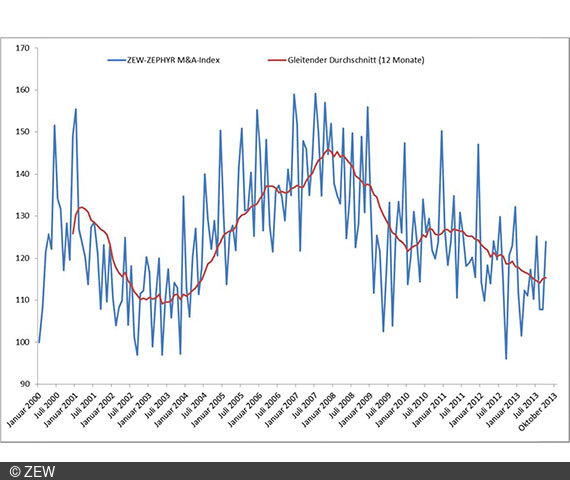

ZEW-ZEPHYR M&A Index – First Signs of Recovery in Worldwide M&A Activities

M&A IndexThe downward trend in worldwide mergers and acquisitions (M&A) as observed in 2012 and the first half of 2013 seems to have stopped. Between July and October 2013, global M&A activities have increased notably, compared to the first half of 2013. In July and October, the ZEW-ZEPHYR M&A Index, which reflects the number of mergers and acquisitions realised worldwide, thus reached 125 and 123 points – the highest index values of the year so far. Global M&A activities are expected to keep recovering until the end of the year. These are the results of calculations by the Centre for European Economic Research (ZEW) based on the database of Bureau van Dijk (BvD).

In the first four months of the second half of 2013, the average number of completed mergers per month climbed to 611 and thus clearly exceeds the number recorded in the previous half (535 transactions). Correspondingly, the monthly index values between July and October range, on average, 5 points above the figures recorded between January and June. “A particularly strong increase can be observed in terms of transactions financed by private equity,” says Tobias Spanka, General Manager of Bureau van Dijk. “In this area, both, the number of deals and the cumulative volume of deals have multiplied since 2012.”

Worldwide M&A activities are expected to continue growing in the last two months of the year. Experience has shown that, with the end of the year approaching, an above-average number of mergers and acquisitions is realised. In 2012, 2011 and 2010, for example, the number of December transactions alone was about 30, 43 and 50 per cent higher than the values recorded between January and November of the corresponding year.

In the long term, the positive signals of the second half of 2013 are reflected in the twelve-month moving average. In Mai 2010, it had started to fall substantially. Since August, however, it has been on the rise again two months in a row. This is the first growth of the twelve-month moving average recorded since September 2012.

Contact

Florian Smuda (ZEW), Phone +49 621/1235-233, E-mail: smuda@zew.de

ZEW-ZEPHYR M&A Index Germany

The ZEW-ZEPHYR M&A Index is calculated on a monthly basis by the Centre for European Economic Research (ZEW) and Bureau van Dijk (BvD) and has been tracking the development of mergers and acquisitions worldwide since the beginning of 2000. The ZEW-ZEPHYR M&A Index is based on the number and the volume of global mergers and acquisitions recorded in BvD’s ZEPHYR database. The index uses the monthly rates of change of both volume and value of M&A transactions, combined and adjusted for volatility and inflation. As a result, the index offers a much more precise picture of the level of worldwide M&A activities than a mere observation of the transaction volume. The reason for this is that a firm’s value on the stock exchange has a strong impact on the transaction value, particularly since many acquisitions are paid for by an exchange of shares. Consequently, stock prices could have a disproportionately strong influence on how the development of M&A transactions is assessed. If the volume is spread over a larger number of transactions within one month, however, the value of the M&A Index increases even though the aggregate transaction value remains unchanged.