M&A Report - The Volume of Megadeals Is on Track to Reach Record Values in 2015

M&A IndexAccording to forecasts, the value of worldwide mergers and acquisitions (M&A) completed in 2015 is likely to reach record levels. Favourable financing conditions as well as numerous companies' plans for growth are driving the major increase in the number and volume of megadeals (transactions with a value of one billion euros or more). This is the finding of an analysis carried out by the Mannheim Centre for European Economic Research (ZEW) on the basis of the Zephyr database of Bureau van Dijk (BvD).

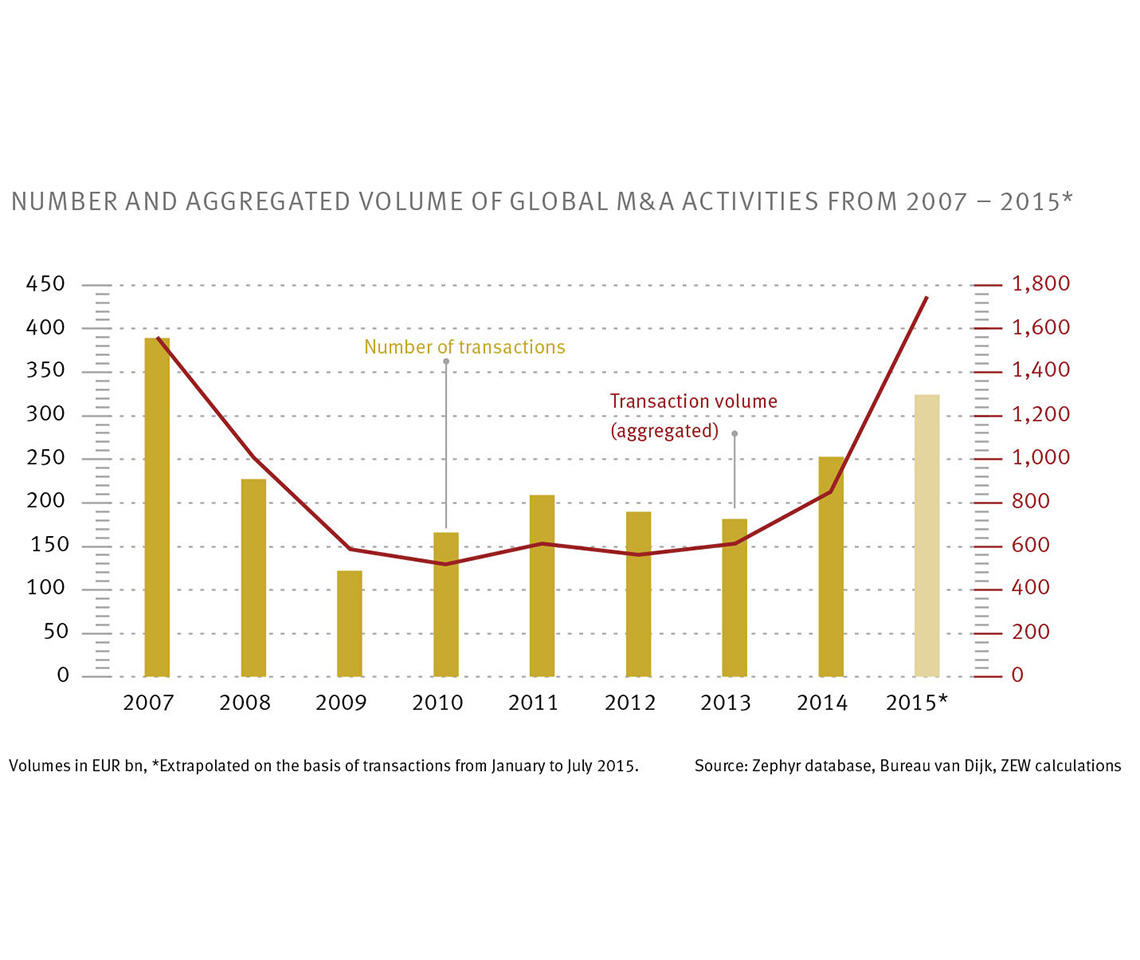

Between January and July 2015, 189 megadeals with an aggregated volume of 1,020 billion euros have already been completed. If the strong M&A activities continue, it can be expected that around 324 transactions with a total value of approximately 1,750 billion euros will take place by the end of the current year. This value would by far exceed the aggregated volume of transactions completed in the years between 2008 and 2014, as well as the hitherto observed record value of 1,560 billion euros achieved in 2007.

Not only the aggregated volume, but also the average size of transactions, currently 5.41 billion euros, is very high this year. In the slow years following the financial crisis, the average size of transactions amounted to just under three billion euros in 2011 and 2012, to 3.37 billion in 2013 and 3.36 billion euros in 2014. In 2007, a strong year for mergers and acquisitions, the average size of megadeals was 4.2 billion euros.

US-based firms participated in the majority of transactions which have taken place this year. Around half of all target firms in M&A activities in 2015 originate from the US. The next most frequent locations of target firms, albeit participating in far fewer transactions than firms in the US, are Great Britain (eight per cent), Australia (four per cent), as well as Canada and France (each three per cent). Comparing data from previous years regarding the location of firms involved in M&A activities, it is notable that Russia is no longer included amongst the most popular countries for transactions. In 2015, only one transaction has involved a Russia-based firm. In the previous eight years, Russian target firms participated in around four per cent of all mega deals.

Fore more information please contact

Dr. Mariela Borell, Phone +49(0)621/1235-144, E-mail borell@zew.de