Mixed Outlook for GDP Growth in Germany

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomists Expect Positive Trend in European Foreign Trade

Business cycle experts anticipate a weak short-term GDP growth for both Germany and the eurozone, while the outlook for the coming year is more optimistic. The experts are confident that despite some challenges, the long-term growth pace will be maintained in both regions, leading to overall economic stabilisation. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

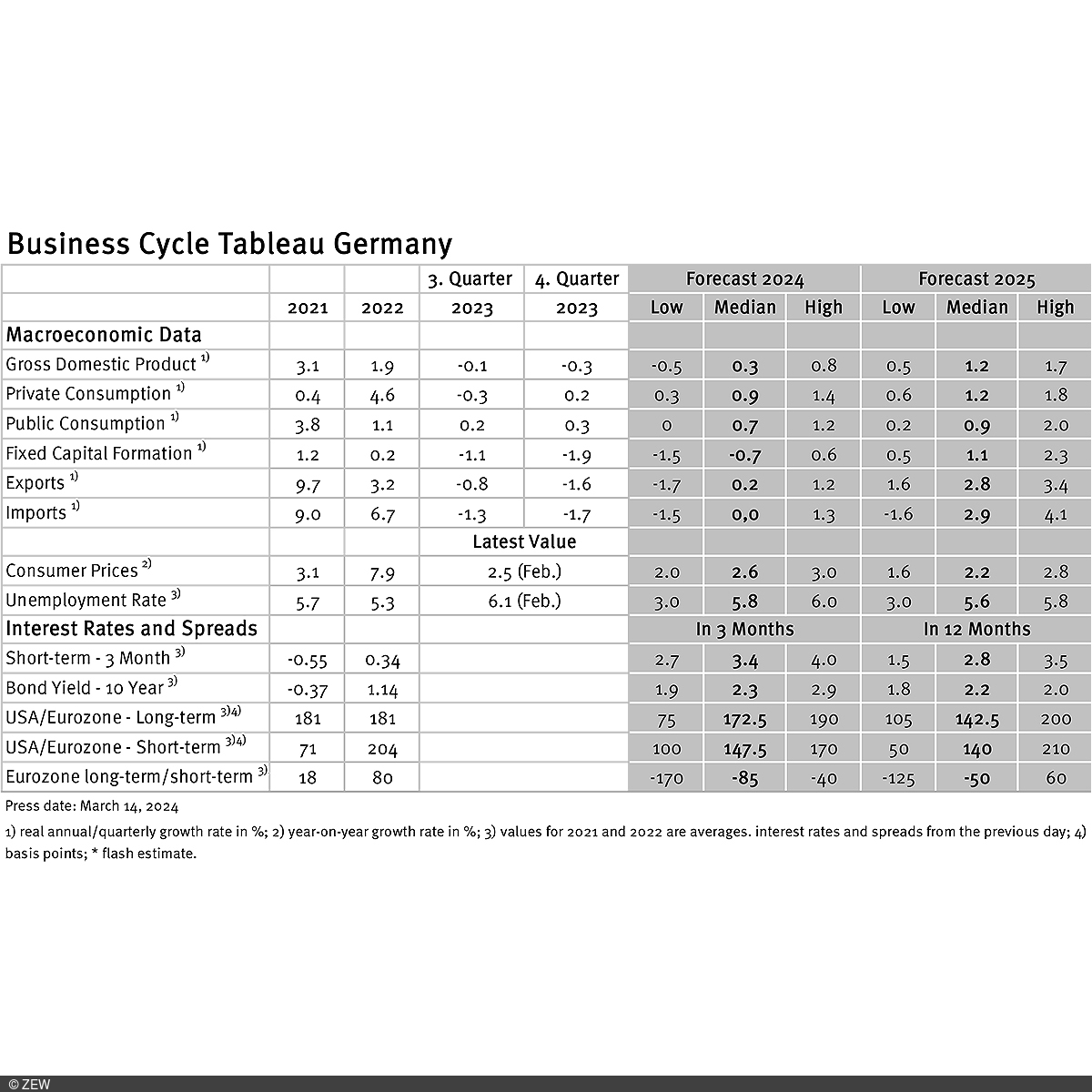

The quarterly growth figures for real GDP in Germany show a decline of 0.1 per cent in the third quarter of 2023 and of 0.3 per cent in the fourth quarter of 2023. For the current year, experts predict a 0.3 per cent increase in German GDP, remaining unchanged from February. The range of individual growth expectations, however, narrows by 0.5 percentage points to 1.3 points, indicating growing consensus among experts. Similarly, the 2025 growth forecast holds steady at 1.2 per cent, markedly higher than the projection for 2024. Notably, the outlook for capital investments is much more pessimistic, dropping from a forecasted 1.7 per cent growth in the previous month to now 1.1 per cent. In contrast, import forecasts for 2025 show a slight uptick, rising by 0.2 percentage points to 2.9 per cent.

Eurozone: Cautious outlook for 2024, positive projections for 2025

Quarterly growth in the eurozone registered a marginal decline of 0.1 per cent in the third quarter and a modest 0.1 per cent increase in the fourth quarter. As already seen in February, expectations for 2024 have fallen slightly again, with forecasts down by 0.1 percentage points to 0.6 per cent. However, economic growth expectations for 2025 remain stable at 1.5 per cent. A comparison between Germany and the euro area reveals that Germany’s performance, both presently and in future prospects, lags behind the rest of the eurozone.

Approaching the ECB inflation target

Inflation rates in Germany and the eurozone continue to decline and approach the ECB’s two per cent inflation target. In February, inflation rates stood at 2.5 per cent for Germany (down 0.6 percentage points from January) and 2.6 per cent for the eurozone (down 0.2 percentage points from January). Looking at the entire year 2024, average inflation is expected to be 2.6 per cent for Germany and 2.4 per cent for the eurozone. In both cases, expectations are 0.1 percentage points lower than February’s figures. Furthermore, the range of individual expectations has narrowed significantly. These currently stand at one percentage point for Germany (down 3.4 percentage points from February) and 0.8 percentage points for the eurozone (down 2.8 percentage points). Projected inflation rates for 2025 remain at 2.2 per cent for both Germany and the eurozone, consistent with the previous month’s values.

Little change in monetary policy expectations

Following the Governing Council meeting on 7 March, where the key interest rate was held steady at 4.5 per cent, monetary policy expectations have changed only slightly. Expectations for short-term interest rates have fallen by 0.1 percentage points to a new value of 3.4 points, compared to February. Thus, experts anticipate declining interest rates still within the current year. Forecasts for 2025 also dropped by 0.2 percentage points to 2.8 points, remaining below the 2024 level.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.