Digital Connectedness in Firms – Private Customers Often Come Last

ResearchAs part of digital transformation, firms are integrating their value chains using technology. However, only one third of firms in the German business economy are digitally connected with their private customers. It is far more common for firms to connect with their corporate clients and suppliers. These are the findings of the “Monitoring Report DIGITAL Economy 2017 – Compact”, compiled by the Mannheim-based Centre for European Economic Research (ZEW) in collaboration with Kantar TNS, on behalf of the Federal Ministry for Economic Affairs and Energy.

While the economy has been growing progressively more digitalised for decades, connectivity is the new element that particularly characterises the digital transformation taking place currently. Connectivity allows the different stages in the value-added chain to exchange information with one another, leading to increased efficiency. Corporate and private clients can be incorporated into the value chain and thus provide the impetus for improvements and new innovations.

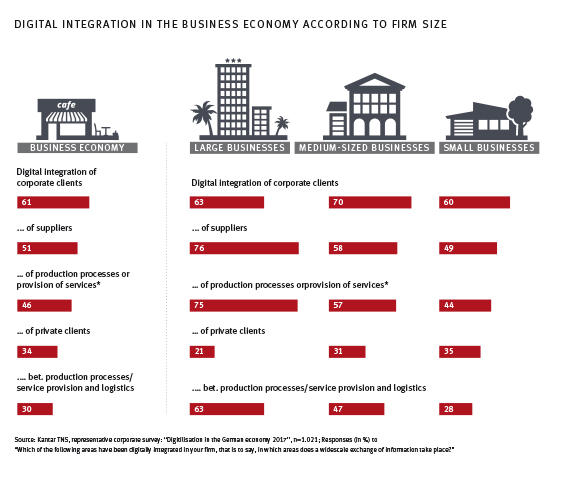

In total, 61 per cent of firms in the business economy have already digitally integrated their corporate clients and 51 per cent have done so with their suppliers. In 46 per cent of firms, production or the provision of services was also digitally integrated.

You can only (technically) integrate processes that have already been digitalised

“It is not surprising that sectors already displaying a high degree of digitalisation have also digitally integrated their processes for production or the provision of services intensively,” says Professor Irene Bertschek, head of the ZEW Research Department “Information and Communication Technologies”. Top of the list is the ICT sector, in which three quarters of firms have digitally integrated their production or service provision processes. Right behind the ICT sector are the financial and insurance sectors as well as knowledge-intensive service providers, with 66 per cent of firms in each of these sectors being digitally connected.

“These sectors are for the most part not just working with individual digital solutions for individual production processes, but have actually connected these processes digitally. This means that information and data can be exchanged, which leads to processes being designed more efficiently. Some of the sectors falling behind include healthcare as well as transport and logistics. In the case of healthcare, there may occasionally be a regulatory framework hampering widescale connectivity or data exchange. In the case of transport and logistics, there are often no production or service processes to digitalise, so digital networking is less relevant in this sector,” explains Irene Bertschek.

Barely a third of firms are integrating production and logistics

Far less common is connectivity with the agents at the end of the value chain. Barely a third of firms, usually large firms as well as companies in the manufacturing and retail sectors, are integrating production and logistics. This trend is, however, reversed when it comes to connectivity with private clients, with the one third of firms claiming to be digitally connected with private customers being largely made up of small firms and service providers. These firms can, for example, use relatively inexpensive social media applications for marketing and to gather customer feedback.

“Given that studies have shown the benefits of incorporating private customers as a source of new ideas as part of an open innovation process, it is astonishing that more companies are not yet making use of digital connectedness in this way,” says Bertschek.

For further information please contact:

Prof. Dr. Irene Bertschek, Phone +49 (0)621/1235-178, E-mail bertschek@zew.de