ZEW-ZEPHYR M&A Index Germany: Average Volumes of Mergers and Acquisitions Climbs to Record Level

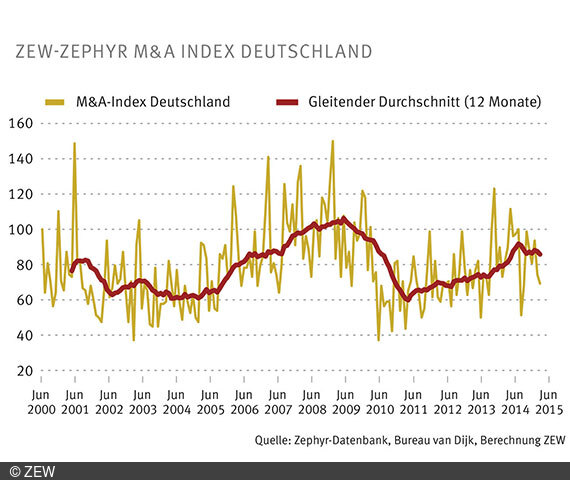

M&A IndexIn the course of 2015, the average transaction value of mergers and acquisitions (M&A) involving German companies has risen to a record level. The number of M&As has stagnated, however. As a result, the ZEW-ZEPHYR M&A Index has shown little variation in 2015. This is the finding of an analysis carried out by the Mannheim Centre for European Economic Research (ZEW) on the basis of the Zephyr database of Bureau van Dijk (BvD).

A significant trend in favour of large deals can currently be observed. In September 2013, the twelve-month moving average of deal values (only deals for which the transaction volume was known were considered) totalled 116 million euros per deal. Since then, this figure has risen constantly, tripling in value, to an average of 303 million euros per transaction (June 2015). This value constitutes the highest average deal volume recorded since measurement began in 2000.

"The increase in transaction volumes is largely due to the re-entry of big players in the M&A market," says ZEW researcher Sven Heim. During the financial crisis, beginning in 2007, such large companies preferred to restructure and streamline activities. In that period, the M&A market was characterised by the activity of small and medium-sized companies. Since then, however, strategic mergers and acquisitions have once again been taking place between sector giants.

The number of M&A transactions has stagnated in 2015. This is also illustrated by the twelve-month moving average of the ZEW-ZEPHYR M&A Index, which is yet to show any significant variation this year. In the course of 2015, this value has varied only very slightly between 86 and 88 index points. Given that mergers and acquisitions usually occur in waves, it is not clear whether the current trend constitutes an orientation phase or whether the number of M&A transactions has already reached its peak.

The ZEW-ZEPHYR M&A Index measures the number of M&A transactions completed in Germany each month. It considers only mergers and acquisitions conducted by, and with German companies. No differentiation is made with respect to the country of origin of the buyer or partner involved. This means that German as well as foreign companies, acting as buyers in transactions, are taken into account, while all target companies considered are active in Germany.

The ZEW-ZEPHYR M&A Index Germany is created by ZEW and BvD on the basis of the ZEPHYR data base. ZEPHYR provides information on more than a million M&As, IPOs and private equity transactions worldwide.

For more information please contact

Sven Heim, Phone +49(0)621/1235-183, E-mail heim@zew.de