ZEW-PwC China Economic Barometer - Government Industrial Policy Raises Skepticism Among German Managers in China

ResearchSkepticism is increasing among managers of German firms in the People’s Republic concerning regulatory conditions in the world’s second largest economy. The majority of decision-makers, however, still expect the trade activities of German firms in China to grow in the upcoming six months. This is the key result of the ZEW-PwC China Economic Barometer in the third quarter of 2014. The ZEW-PwC China Economic Barometer surveys executives of German firms in China about their expectations regarding the overall macroeconomic development, the development of the legal and regulatory environment, as well as investment and merger activities in various industries.

The share of participants who expect improvements with respect to important regulatory factors such as new business approvals, access to financing, corporate taxes or public tenders has declined in comparison to the second quarter. At the same time, the share of managers who expect at least a slight worsening of conditions in these areas within a six month-horizon has increased. These shifts possibly reflect the effect of recent industrial policy initiatives of the Chinese central government with the objective to apply existing competition protection regulations more rigidly.

The ZEW-PwC China Economic Barometer also points towards increasing uncertainty among German managers concerning the short-run evolution of business cycle conditions in China. According to the executives’ estimates, the current probability of a notable improvement in macroeconomic conditions is 30 per cent as compared to 50 per cent nine months ago. At the same time, the estimated probability of a notable deterioration of the business cycle situation has more than doubled to 26 per cent. "Despite the increase in public spending implemented earlier this year, some economic fundamentals have recently missed their targets to a considerable extent. This reflects in the managers’ opinions regarding both the current business cycle situation and their macroeconomic expectations", says Jens-Peter Otto, partner and China expert at PricewaterhouseCoopers (PwC).

The diminishing optimism about the macroeconomic development in China is likely connected to recent government investigations against potential competition law infringements. The investigations were partly targeted at German car producers, who are generally considered the market leaders in the huge domestic market in China, but also at foreign producers of intermediate goods in the automotive industry. "The more consequent application of existing domestic competition laws has of course come to notice among German companies’ executives, not only in the automotive sector", says Oliver Lerbs, who is in charge of the ZEW-PwC China Economic Barometer at the Centre for European Economic Research (ZEW). In contrast to the previous quarter, a majority of the participating experts expect inward foreign direct investment in China to decrease in the next six months.

Trade activities of German companies in China maintain upward trend

Despite the possibility of further policy interventions and uncertainty about future macroeconomic growth prospects, the majority of German company executives remain optimistic about the development of their own trade activities in China. However, the managers’ consent has become weaker: Whereas the margin between optimistic and pessimistic assessments was 60 points at the end of 2013, the respective margin has gradually narrowed to the current level of 36 points. The number of optimists in the panel still clearly outmatches the number of pessimists.

According to the surveyed decision makers, further growth in mergers and acquisitions (M&A) activities of Chinese firms abroad is to be expected: Compared to the previous quarter, the respective margin of positive and negative assessments has decreased by eight points, but still ranks at a level of 61.8 points. The role of Germany as an M&A destination also is seen somewhat less optimistic, but is still considered to be strong: "Some recent M&A engagements by Chinese investors, for example in the car industry and in the manufacturing sector, have raised a lot of public interest. These activities have underscored that Chinese companies not only aim at improving knowledge access, but also seek to develop new channels of distribution and sales in Germany", Otto explains.

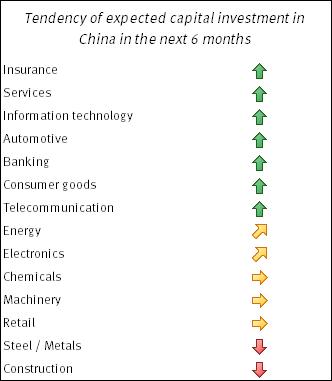

With respect to the expected development of capital deepening in different key industries, no major change is observed for eleven out of 14 sectors. Retail, energy and manufacturing were subject to slightly diminishing expectations. The strongest increases in capital investment are expected for insurance and services, while the managers expect further reductions of excess capacities in the steel and metals and construction industries.

Special topic: Future ways of corporate financing among German companies in China

For the first time, participants in the ZEW-PwC China Economic Barometer were asked to respond to a set of special questions dealing with current managerial problems in the context of their trade activities with China. In the third quarter 2014, the executives provided information on which forms of financing will gain most in importance for financing business activities in China in the next two years. Equity financing by means of retained profits was seen as one of the most relevant future financing forms by four out of five participants. The possibility to finance future investments by means of recent cash flows points towards generally favorable earnings conditions of German companies in China. Equity financing by the parent company was regarded as the financing option with the highest growth prospect by 49 per cent, while 32 per cent considered debt financing by the parent company the most prominent option. Debt financing from Chinese banks or the Chinese capital market is apparently much less important (twelve and five per cent, respectively) due to administrative barriers. Nevertheless, a surprisingly large share of 22 per cent of the managers can imagine issuing corporate bonds in China in the medium term, in which the so-called "Panda Bonds" play the main role (17 per cent). However, only 2.4 per cent of the executives actually envisage the emission of a corporate bond in Mainland China within the next two years. So far only one major German industrial company has ventured the raise of debt at the Chinese domestic capital market.

42 executives of German companies in China participated in the ZEW-PwC China Economic Barometer survey for the third quarter 2014, which was conducted during August 11 and August 28.

For further information please contact

Dr. Oliver Lerbs, Tel.: +49-621-1235-147, Email: lerbs@zew.de

Prof. Dr. Michael Schröder, Tel.: +49-621-1235-140, Email: schroeder@zew.de