Innovative Companies Are More Resilient to Crises

ResearchImplications of the Coronavirus Pandemic for Research and Development

The economic consequences of the coronavirus pandemic will most likely force companies to also reduce spending on research and development (R&D). However, experiences from past recessions show that innovative companies are significantly more resilient and less likely to lay off workers than companies without innovations. The current coronavirus crisis has required many companies to develop creative solutions for products. They have, however, had less opportunities to cooperate with external partners like they had in past crises. This will most likely make conditions for company investments in R&D more difficult, especially in light of the fact that their own R&D workers currently have to work from home. These are the results of a recent ZEW policy brief published by ZEW Mannheim and the AIT Austrian Institute of Technology.

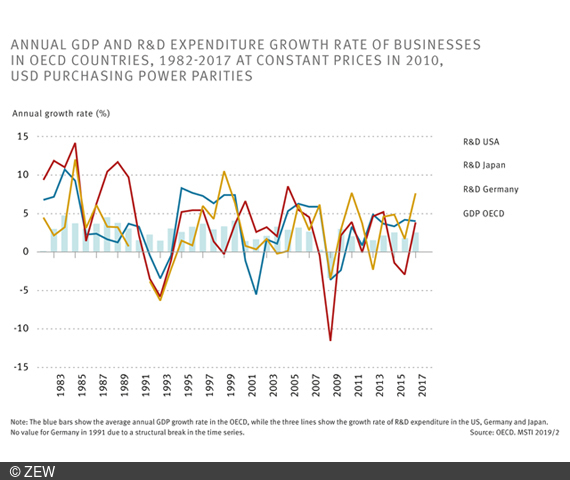

Numerous forecasts currently suggest that the coronavirus pandemic will push many European states into recession. This will most likely also reduce the companies’ willingness to invest in R&D and limit their ability to bring new products and services to the market. Economic research has, however, shown that R&D is a key driver for growth and, as such, vital for economic recovery after the COVID-19 crisis. This engine of growth is currently at risk.

Previous recessions have also shown that crises do not affect companies equally. During the financial and economic crisis of 2008/09, for instance, those who suffered most were companies engaged in international trade. “For Germany, we can therefore expect that the innovation activities of export-oriented companies will be particularly hard hit by the current coronavirus crisis,” says Professor Bettina Peters, deputy head of the ZEW Research Department “Economics of Innovation and Industrial Dynamics” and co-author of the ZEW policy brief.

Furthermore, small and medium-sized enterprises are more likely to face liquidity and funding constraints as a result of crises. Larger Companies, on the other hand, have more internal financial resources and better access to lending markets. “It is a good thing that governments of several European countries have adopted support measures for businesses. If the crisis continues for a longer period of time, companies will most likely run into liquidity constraints,” explains ZEW President Professor Achim Wambach. “This will in turn limit their ability to invest in research and development.”

Coronavirus crisis: A chance also for more innovation?

While most companies in Germany adjust their R&D expenditure according to economic cycle and reduce R&D spending during recessions, around 34 per cent of German companies increased their innovation activities in a counter-cyclical way during the financial crisis of 2008/09. As a result, innovative companies were better able to cope with the consequences of the recession and, for example, did not have to cut as many jobs as companies that do not or only rarely engage in innovation activities.

As a matter of fact, the coronavirus crisis has forced many businesses to develop new business models at short notice, like in the gastronomic sector, in delivery services and in many other sectors by offering new digital services. However, R&D is a collaborative process that requires the cooperation and steady exchange of several people, in addition to the use of technical facilities such as laboratories or workshops. Working from home thus hinders R&D activities. “While the current crisis leaves more time for creativity, we will most likely see less counter-cyclical innovation activity than in the financial crisis of 2008/09,” concludes Peters.

As potential policy measures, the authors of the ZEW policy brief suggest direct and indirect financing instruments, which can help particularly small and medium-sized enterprises to overcome liquidity constraints for innovation projects and stabilize economic expectations. In this current crisis, however, the underlying problem is the restriction on economic life. When social and economic life returns back to normal, additional financial resources may be necessary to prevent companies from abandoning their innovation activities for good. “This kind of funding should be targeted at small and medium-sized firms in particular,” says Bettina Peters.