Global Mega Deals Experience Considerable Drop

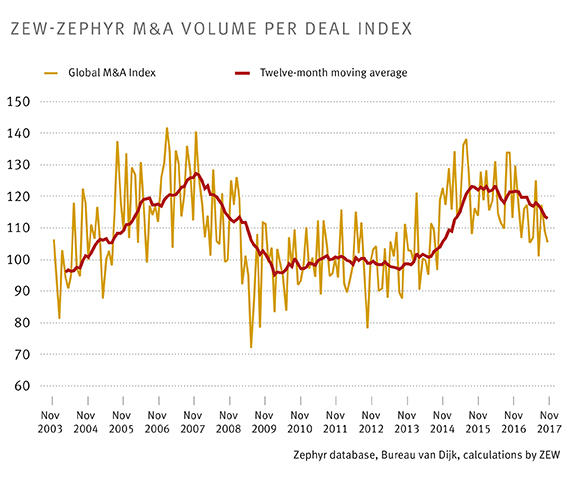

M&A IndexFollowing two record years for mergers and acquisitions (M&A) worldwide in 2015 and 2016, this trend appears to have reversed in 2017. In November 2017, the ZEW-ZEPHYR M&A Volume per Deal Index’s twelve-month moving average was at 113 points, its lowest level since April 2015. November was the eleventh month in a row that the twelve-month moving average continued to fall, a trend that was last seen during the later stages of the financial crisis in 2009. These are the findings of studies carried out by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

While the number of transactions remained almost constant in 2017, there was a significant reduction in the average transaction volume per deal. Particularly striking was the reduction in the number of very large acquisitions. While there were 244 transactions recorded in 2017 with a volume of more than a billion euros, and 18 with a volume of more than ten billion euros, in 2016 there were 315, and in 2015, 350 transactions with a volume of over a billion euros, and 34 (2016) and 37 (2015) deals with a volume of over ten billion euros. The biggest deal observed in 2017 was the merger of the US chemical giants Dow Chemical and EI DuPont, which ran to a total of 51 billion euros and would have made it only the fourth largest if it had taken place in 2016.

The merger represents a further consolidation in the chemical and agricultural sectors, a fact which raised considerable concern from antitrust authorities on both sides of the Atlantic. Though the merger was announced as far back as late 2015, it could only be executed this year due to an exhaustive auditing process. In addition, the merger was only permitted under several conditions, one being that DuPont is required to sell off parts of its product range.

Investors more reticent with their purchasing decisions

The observed downward trend in global M&A is due, firstly, to high company valuations and, secondly, to business developments in the US. “Following years of ‘cheap money’ in the US and Europe, a lot of capital flowed into shares and corporate bonds, leading potential acquisition targets to become considerably more expensive for investors. As a result, investors have been more reticent with their purchasing decisions,” says Niklas Dürr, a researcher in the ZEW Research Group “Competition and Regulation”. At the same time, the US competition authorities are being more stringent in their audits of corporate mergers than originally anticipated. “In the US, there is already talk of a ‘post-Trump nervousness’,” Dürr explains.

Initially, many had assumed that M&A regulations would be less harshly followed under the Trump administration. “However, this prediction has not proven right in the first year of his presidency,” says Dürr. Most significantly, AT&T’s planned 85-billion-dollar takeover of Time Warner in the US media sector will not take place at the moment, largely due to legal disputes with the Department of Justice. “Seeing acquisitions of this size run into problems can lead CEOs – particularly in the US – considering similarly large deals to rethink. In this context, the Trump administration could be seen to be hampering big deals rather than enabling them,” Dürr explains.

For the coming year, there are two large acquisitions on the horizon. In the US health sector, CVS Health Corp plans to acquire Aetna Inc for an estimated 67 billion dollars and in doing so become the biggest player on the health market. Following the merger, the company would have a hand in every aspect of the health sector, from health insurance to a pharmacy chain. The second, and considerably larger, much talked about acquisition involves the Los Angeles-based computer chip manufacturer Broadcom, who plan to buy out their competitor Qualcomm, the world’s largest manufacturer of mobile phone chips, for an estimated 103 billion dollars. Qualcomm, however, have already rejected Broadcom’s first offer, meaning that a hostile takeover could potentially be on the cards in 2018.

About the ZEW-ZEPHYR M&A Volume per Deal Index

The ZEW-ZEPHYR M&A Volume per Deal Index is calculated monthly by the Centre for European Economic Research (ZEW) and Bureau van Dijk and has been tracking the development of mergers and acquisitions completed worldwide since the beginning of 2003. The ZEW-ZEPHYR M&A Volume per Deal Index is based on the number and the volume of global mergers and acquisitions recorded in the ZEPHYR database of Bureau van Dijk. The index uses the monthly rates of change in the relation between volume and number of M&A transactions, which are combined and adjusted for volatility and inflation. If the total transaction volume is attributable to a larger number of transactions within one month, the value of the M&A Index decreases, even though the aggregate transaction value remains unchanged.

As a result, the index offers a much more precise picture of the level of worldwide M&A activities than a mere observation of transaction volumes or the number of transactions.

For more information please contact

Niklas Dürr, Phone +49 (0)621/1235-386, E-mail niklas.duerr@zew.de