Economic Sentiments for China Worsens, But Growth Expectations Remain Positive

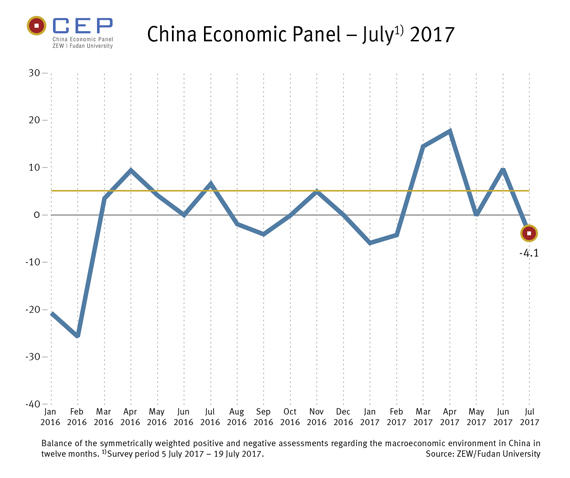

China Economic PanelAccording to the current survey for July (5–19 July 2017), the economic outlook for China has declined significantly, falling by 13.8 points. The CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, is currently no higher than minus 4.1 points (June 2017: 9.7 points) and thus far below the long-term average of 5.1 points.

The high volatility of the CEP Indicator over the past few months therefore shows no signs of ceasing. The survey responses, however, show that the experts’ expectations for the Chinese economy largely oscillate from month to month between “slight improvement” and “slight decline”. In contrast, there are hardly any participants who expect the economic development to “increase significantly” or to “decrease significantly”.

“These frequent fluctuations seen within a relatively short period of time are a clear indication of uncertainty among the experts in terms of their assessment of future growth in China. The experts do not, however, expect great changes,” says Dr. Michael Schröder, senior researcher in ZEW’s Research Department “International Finance and Financial Management” and project leader of the CEP survey. This is also confirmed by the point forecasts for growth of gross domestic product. The forecasts for both 2017 and 2018 remain unchanged from the previous month, with projected growth for 2017 still at 6.7 per cent and for 2018 at 6.6 per cent.

One positive development is that the assessment of the current situation has slightly improved again, with the indicator reflecting the assessment of the current economic situation climbing 2.1 points to a level of 16.7 points.

“What is particularly remarkable about the current survey results is the significant decline in real estate price expectations,” says Michael Schröder. Virtually all regions listed in the survey – except for Hong Kong and Guangzhou – were predicted to see real estate prices drop by more than 20 points and in some cases even 30 points. This correlates with a downturn in expectations for the economic situation in these regions. In this case, however, there has also been a shift in expectations from a “slight increase” towards a “slight decrease”. It remains to be seen whether this change in expectations will have a long-lasting effect on the development of the actual economy.

For further information please contact

Dr. Michael Schröder, Phone: +49 (0)621/1235-368, michael.schroeder@zew.de