Strong Decrease in Expectations

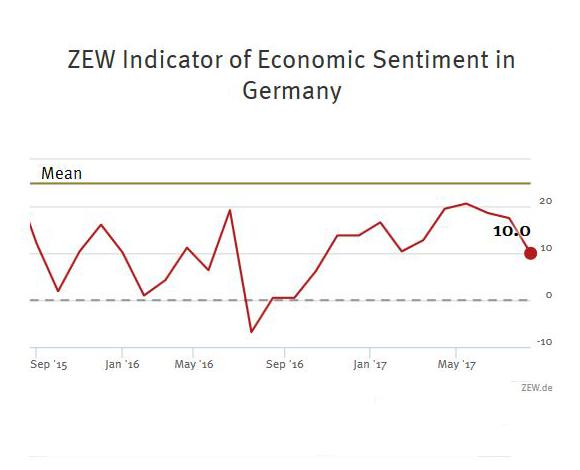

ZEW Indicator of Economic SentimentThe ZEW Indicator of Economic Sentiment for Germany fell considerably by 7.5 points in August 2017 and now stands at 10.0 points. The indicator thus remains significantly below the long-term average of 23.8 points. The assessment of the current economic situation in Germany increased slightly by 0.3 points in August. The corresponding indicator now stands at 86.7 points.

“The significant decrease of the ZEW economic sentiment indicator reflects the high degree of nervousness over the future path of growth in Germany. Both weaker than expected German exports as well as the widening scandal in the German automobile sector in particular have helped contribute to this situation. Overall, the economic outlook still remains relatively stable at a fairly high level,” comments ZEW President Professor Achim Wambach.

The latest GDP statistics show that the German economy grew by 0.6 per cent in the second quarter of 2017 compared to the previous quarter. This is the exact average GDP growth across all member countries in the Eurozone.

The indicator reflecting the financial market experts’ expectations regarding economic development in the eurozone decreased by 6.3 points in August, bringing the expectation indicator to a current level of 29.3 points. The decline of eurozone growth expectations is thus slightly lower than those for Germany.

By contrast, the indicator for the current economic situation in the eurozone has climbed significantly. It currently stands at 38.4 points, 9.7 points higher than in July. Since November 2016, the indicator for the economic situation in the eurozone has been steadily increasing and has now reached its highest level since January 2008.

For further information please contact

Dr. Michael Schröder, Phone +49 (0)621/1235-368, E-mail michael.schroeder@zew.de

Lea Steinrücke, Phone +49 (0)621/1235-311, E-mail lea.steinruecke@zew.de

More information and studies on the ZEW Indicator of Economic Sentiment and the release dates 2017 (as PDF file, 28 KB) and the historical time series (as Excel file, 81 KB)