German M&A Market Starts off Strong in 2017

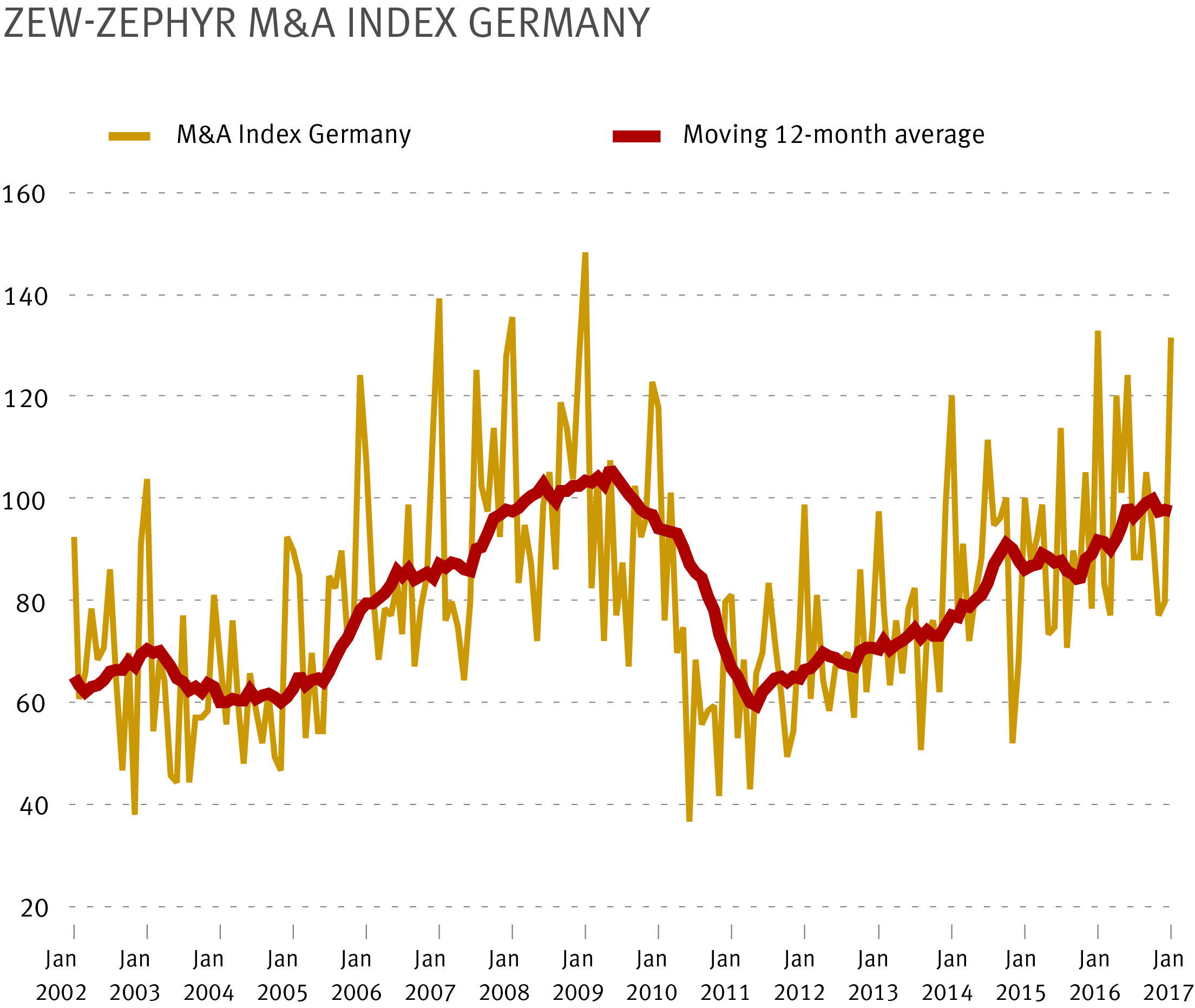

M&A IndexAccording to the ZEW-ZEPHYR M&A Index, mergers and acquisitions (M&A) involving German businesses continue the upward trend seen in the previous months. The index, which is based on the number of completed M&As per month, climbed to 132 index points in January, kicking off 2017 on a very positive note. The only time the index exceeded this level was in January 2016, when the ZEW-ZEPHYR M&A Index recorded a monthly average of 133 points. The moving twelve-month average of the M&A Index has also grown continually. The index currently reads 98 points (as of January 2017) and is thus on the verge of exceeding the 100-point mark for the first time since 2009. These are the findings of studies carried out by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

The largest deal in the past six months was the takeover of the German manufacturer of industrial robots and production machines Kuka. Mecca International, a Chinese electrical appliance manufacturer, spent 3.7 billion euros on the takeover, which was subject of many public debates surrounding the transfer of German technical know-how into Chinese hands. Previous attempts to sell Kuka to a German company had, however, failed.

In the chemical industry, BASF completed its acquisition of Chemetall, a leading global surface treatment business for the auto and aerospace industries, thus succeeding in keeping the company in German hands. The Ludwigshafen-based BASF bought Chemetall for around three billion euros from the US company Albemarle. Before this takeover, the chemicals giant BASF had not made any acquisitions of this scale during the ongoing merger wave in the chemical industry.

From December 2016 to January 2017, the index measured five more deals with a transaction volume of over one billion euros. One of those large-scale acquisitions includes, for instance, the takeover of the German tableware manufacturer WMF by the French company SEB. Another major deal was the French PSA Group’s recent acquisition of the German automobile manufacturer Opel.

ZEW-ZEPHYR M&A-Index Germany

The ZEW-ZEPHYR M&A Index measures the number of M&A transactions completed in Germany each month. It considers only mergers and acquisitions conducted by and with German companies. No differentiation is made with respect to the country of origin of the buyer or partner involved. This means that German as well as foreign companies, acting as buyers in transactions, are taken into account, while all target companies considered are active in Germany.

The ZEW-ZEPHYR M&A Index Germany is created by ZEW and Bureau van Dijk on the basis of the ZEPHYR data base. ZEPHYR provides information on more than 1.5 million M&As, IPOs and private equity transactions worldwide.