British Companies in Great Demand After Brexit

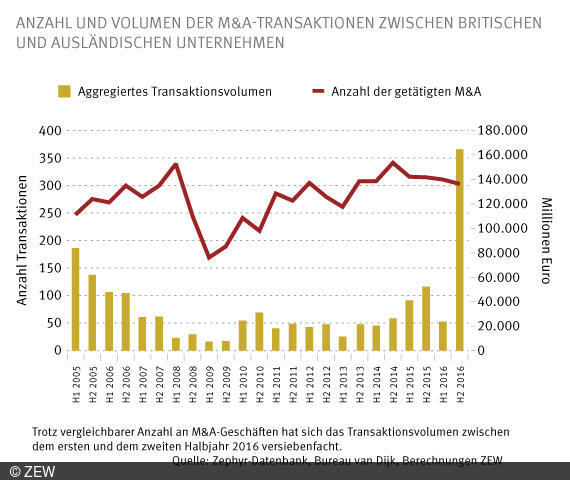

ResearchAlthough the UK has now officially decided to leave the European Union, British companies continue to be highly attractive to foreign companies. Judging by the number of mergers and acquisitions (M&A) of British companies, M&A activities have apparently remained largely unaffected by the Brexit vote in June 2016 since neither a drop nor an increase in M&A was witnessed. By contrast, the financial volume of M&A transactions reached an absolute record high following the Brexit vote. These are the findings of studies carried out by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

In the second half of 2016, the aggregated transaction volume for international M&A targeting British companies amounted to around 164 billion euros. With a volume of 111 billion euros, the by far biggest transaction was Anheuser-Busch InBev's takeover of the brewery SABMiller. However, even without this deal the second half of 2016 would still represent the strongest half year since 2005 in terms of M&A transaction volume.

The second largest transaction involved the takeover of chip designer ARM Holding by the Japanese telecommunication giant SoftBank for around 29 billion euros. Besides, there were also acquisitions with purchase prices between one and two billion euros in various sectors, including the insurance sector (Abbey Life), the cinema sector (Odeon & UCI), trading companies (Darty), as well as the pharmaceutical industry (AstraZeneca).

Michael Hellwig, researcher in ZEW's Research Group "Competition and Regulation", comments on the results, "Given the weak pound as a result of Brexit, foreign companies seem to have taken advantage of this opportunity to purchase British companies at a favourable price."

For further information please contact:

Michael Hellwig, Phone: +49(0)621 1235-233, E-mail: hellwig@zew.de