Stocks Significantly More Attractive than Bonds and Real Estate in 2018

ResearchIn 2018, stocks remain as attractive for investors as in 2017, whereas government and corporate bonds, as well as real estate, are considered to be significantly less profitable investment options than in the previous year. This is the result of a special question in the ZEW Financial Market Survey conducted by the Centre for European Economic Research (ZEW) in Mannheim.

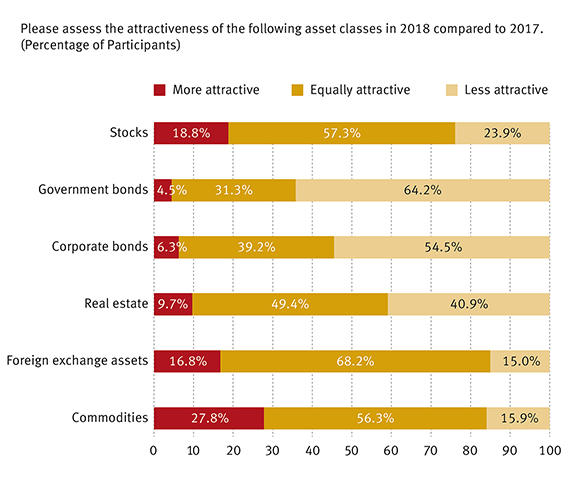

In this special question, financial market experts were asked which asset classes they thought were likely to perform well in the upcoming year. Furthermore, they were asked to assess the most important asset classes, indicating whether they consider them to be more attractive, equally attractive or less attractive in 2018 compared to 2017.

Despite the fast growth witnessed in the past few months, stocks are considered to be just as attractive for investors in 2018 as in 2017, according to the vast majority of survey participants (57.3 per cent). While 23.9 per cent of the experts believe that stocks could experience a negative development, this negative assessment is offset by those experts who expect stock market performance to improve over the course of the year (18.8 per cent).

Traditional asset classes assessed less favourably

The development of “traditional” types of investment in 2018, such as government and corporate bonds or real estate, was assessed far less favourably compared to the performance of stocks. For instance, around 64.2 per cent of the survey participants expect this year’s government bond yields to be lower than those in 2017. “Long-term interest rates are currently extremely low and there is little chance of rates falling further and share prices rising in the foreseeable future,” explains Lea Steinrücke, a researcher in the ZEW Research Department “International Finance and Financial Management”. The development of corporate bonds was assessed almost as negatively.

The nationwide real estate boom in recent years has increased scepticism over the growth potential of property prices in 2018. Around 40.9 per cent of the financial experts consider real estate to be a less attractive investment option in 2018 than in the previous year. At the same time, however, a total of 49.4 per cent of the survey participants still expect property investments to remain as attractive for investors as it was in 2017. Foreign exchange assets and commodities – rather exotic asset classes for private investors – were assessed more positively, with the majority of the financial experts rating them as “equally attractive” or even “more attractive” for 2018.

For further information please contact:

Lea Steinrücke, Phone +49 (0)621/1235-311, E-mail lea.steinruecke@zew.de