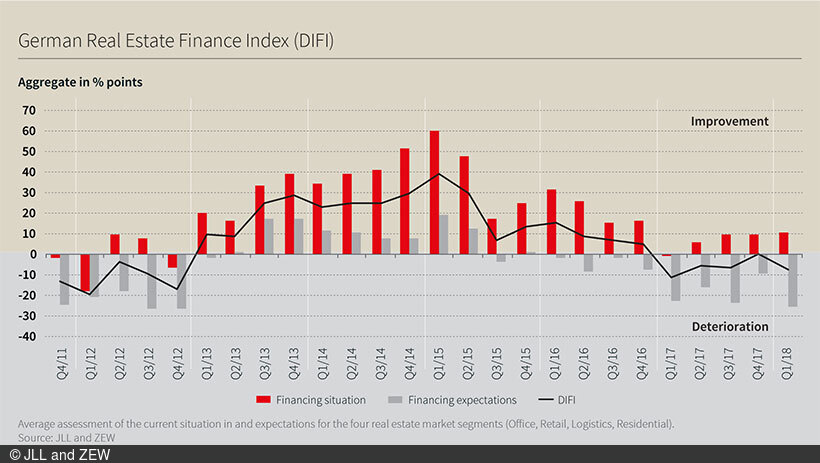

DIFI Report by ZEW and JLL – Outlook for Real Estate Financing Sours Despite Positive Financial Climate

ResearchDespite the current positive financial climate, the German Real Estate Finance Index (DIFI) by ZEW and JLL dropped by 7.9 points in the first quarter of 2018 to a current reading of minus 7.8 points. This drop can be attributed to worsening business expectations with regard to commercial real estate financing. Current sentiment remains positive, however, the only exception being in the case of retail property financing.

According to experts at JLL and ZEW, the main reasons for these worsening expectations are the ongoing intense competitive pressure among financial backers and increased uncertainty over future demand for real estate financing. Survey participants gave a particularly pessimistic assessment of the future development of retail property financing. Despite optimistic prognoses for this sector in 2018, falling floor-space turnovers and a lower number of new leases are dampening demand for financing. These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial property financing market. It is conducted on a quarterly basis and calculated as the average value of the balances in the following four sectors of the property market: office, retail, logistics and residential. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by JLL and the Centre for European Economic Research (ZEW). 43 experts participated in the January/February 2018 survey.