The Fiscal Effects of Foreigners and Immigration in Germany

ResearchThe 6.6 million residents with foreign citizenship who lived Germany in 2012 will pay EUR 147.9 billion more taxes and social insurance contributions than they receive as social transfers over the remaining life cycle. The surplus arises despite their still substantially weaker labour market and income position compared to German nationals. This is one of the key findings of a study by the Centre for European Economic Research (ZEW) on behalf of the Bertelsmann Foundation that was published in November 2014. Using generational accounting instruments, the study also shows that future immigration could reduce the long-term fiscal burden on the domestic population that is the result of the sizeable sustainability gap in Germany’s public finances. The prospect of a positive fiscal externality demands that future immigrants to Germany will be at least as skilled, on average, as the incumbent population today.

Assuming economic and fiscal parameters remain unchanged, the projected aggregate of taxes and contributions paid by the ageing foreign residents over the remaining life cycle exceeds the total of the claimed personal social transfers by EUR 22,300 per citizen with foreign nationality. The balance of tax payments and social transfers of the foreign population, calculated on the basis of the latest demographic and fiscal data, is more positive than in earlier generational studies for Germany. The study attributes the improvement to the strong performance of the labour market, which led to a general decline in unemployment and, at the same time, to a decrease in the unemployment rates of foreigners.

However, better economic integration could render the overall fiscal contribution made by foreign residents much larger. This is shown in a counterfactual calculation: If one out of two foreign residents exhibited the same fiscal characteristics as the average of German residents, the accrued net payment of non-German residents into the public budget over the remaining life cycle would be approximately four times as large. Against the backdrop of the prospect of substantial fiscal revenues, the study recommends intensifying the efforts to improve the labour market integration of foreign residents, in particular through better education.

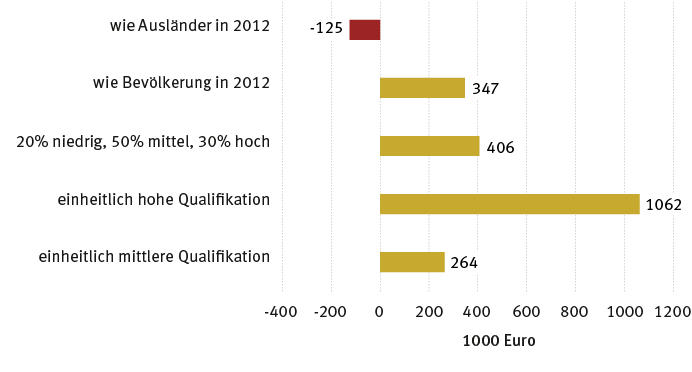

The ZEW study also incorporates a sustainability analysis of current fiscal policy parameters in Germany, which shows a total deficit in the intertemporal public budget of 146.6 per cent of current Gross Domestic Product (GDP) in a scenario without any future immigration. In order to clear this implicit debt, which is much larger than the explicit national debt of 78 per cent of GDP, each citizen from now on would have to make an additional lump-sum contribution to the public coffers of EUR 1,082 per year. Assuming a constant net intake of 200,000 immigrants per year, this burden may grow or shrink, depending on the skill level of future immigrants. If future immigrants on average exhibited the same low education levels of the current population with foreign citizenship, the annual lump sum necessary to achieve sustainable public finances would increase by EUR 125, compared to the "no immigration scenario". In a moderate scenario of only medium-skilled immigration, by contrast, each citizen would benefit from an annual lump-sum relief of EUR 142. In a scenario with future immigrants who approximately have the skill composition of the immigrants who arrived in Germany from 2008 to 2009, i.e. 20 per cent low-skilled, 50 per cent medium-skilled and 30 per cent high-skilled, the incumbent population would benefit from an annual per capita fiscal relief of EUR 406.

An annual net immigration of 200,000 people alone, however, will not suffice to close the sustainability gap in the German public finances. This goal is only achieved in an unrealistic scenario, in which all future immigrants hold a tertiary degree. Nevertheless, a key message of the study is that Germany has good chances to achieve a noticeable fiscal relief for its population through a human capital-oriented immigration policy to attract economic migrants who have good chance to be absorbed in the thriving labour market.

For more information please contact

Professor Holger Bonin, Phone +49/621/1235-151, E-mail bonin@zew.de